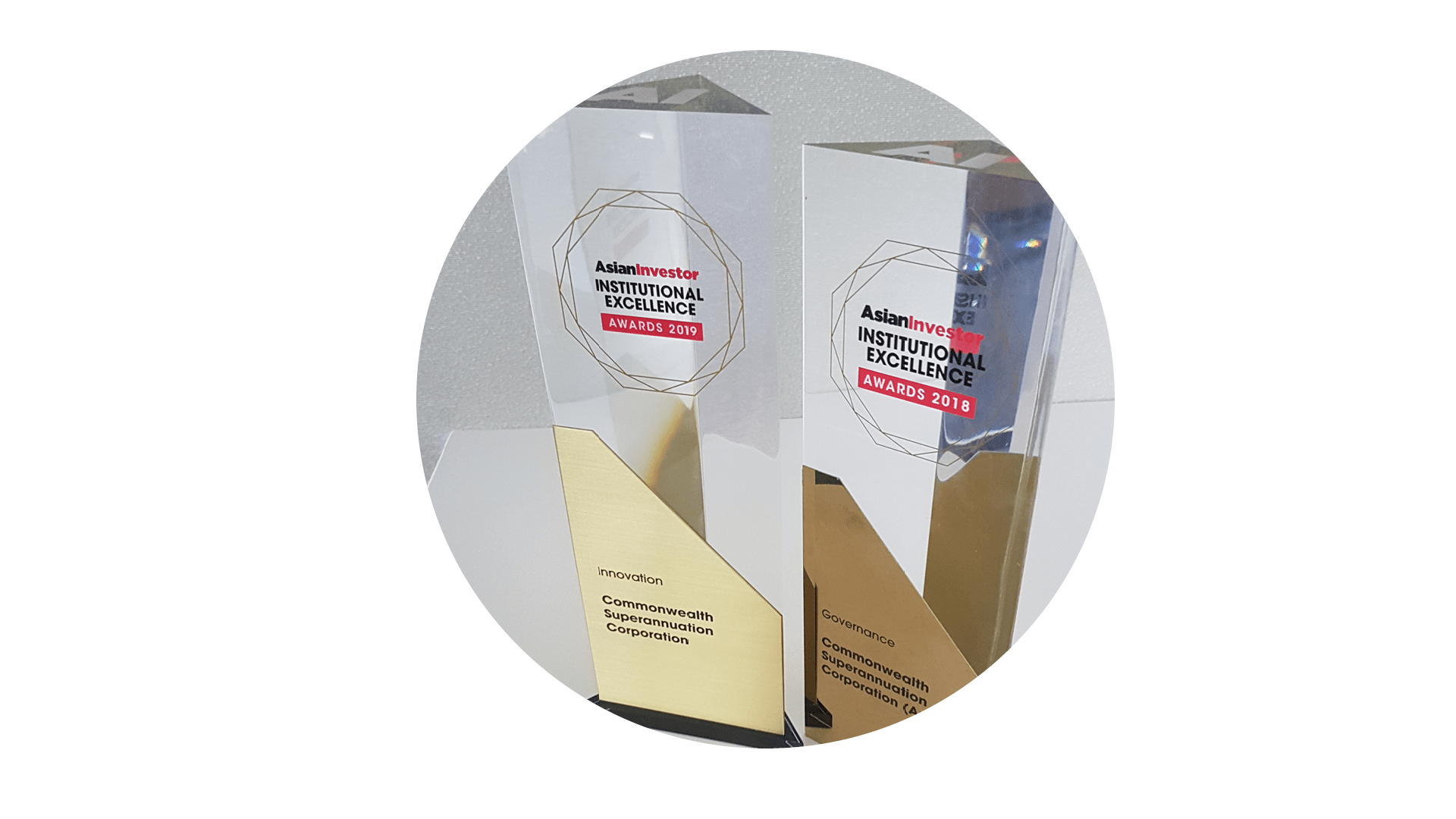

CSC awarded for innovation in investment

CSC is delighted to receive the AsianInvestor Institutional Excellence Innovation Award in 2019, after being awarded the AsianInvestor Institutional Excellence Governance Award in 2018.

16 Dec 2019

CSC’s investment capability is unique within the Australian super industry because of our complementary barbell of global best-practice governance and innovation. We have a differentiating combination of strengths in our investments (by design and operation) that will ultimately maximise the probability of delivering comfortable retirement for our members.

Governance and Innovation are part of every CSC team member’s responsibility. To us, it simply means seeking continuous improvement—incremental or transformational—across all aspects of our portfolio to create value for our customers. We do this in a robust and prudent way that grows our customers’ wealth, and safeguards it through the ups and downs of the market.

When we talk about ‘governance’ we’re not referring to red tape, bureaucracy and prescriptive box ticking. Governance is about having clear accountability and delegations to support effective decision making.

Innovation doesn’t mean we’re chasing the latest fad, or fastest trending hashtag. Innovation is about nimble decision making to take advantage of the best ‘value for money’ opportunities and proactively prepare for emerging risks.

We believe that robust investment governance sets the fundamental framework for continuous innovation. We have been investing in our own governance and controls for more than a decade in order to embed agile decision-making. This gives us a capacity for first-mover advantage into the industries and assets expected to drive growth in the future. We have a strong history of identifying issues and trends before others do, which enables us to better ‘future proof’ customer savings.

This combination of attention to detail and accountability through best-practice governance levered into a well-controlled, transparent capacity for innovation allows us to access high-quality assets in an increasingly competitive market.

These competitive advantages are likely to become even more important as we face more complex and uncertain global macro and financial conditions ahead. Financial markets are becoming increasingly vulnerable to discrete shifts in investor risk appetite. As investors adapt in this unfamiliar operating context, traditional tools and assets will be insufficient for achieving investor objectives. We’ll continue to look forward and innovate to search for the most appropriate opportunities to improve our members’ income adequacy in retirement.